What’s Going on Behind the Scenes? Why is it Changing?

About six million people travel in planes each day worldwide. With the increase in flight cancellations and other disruptions, many travelers are suddenly curious about how in the world all those seats get booked. For those of us in the industry, trying to explain it is not really that easy. It’s a story loaded with acronyms. It’s a plan in flux. There are many more moving parts in travel management than a reasonable person wants to hear about.

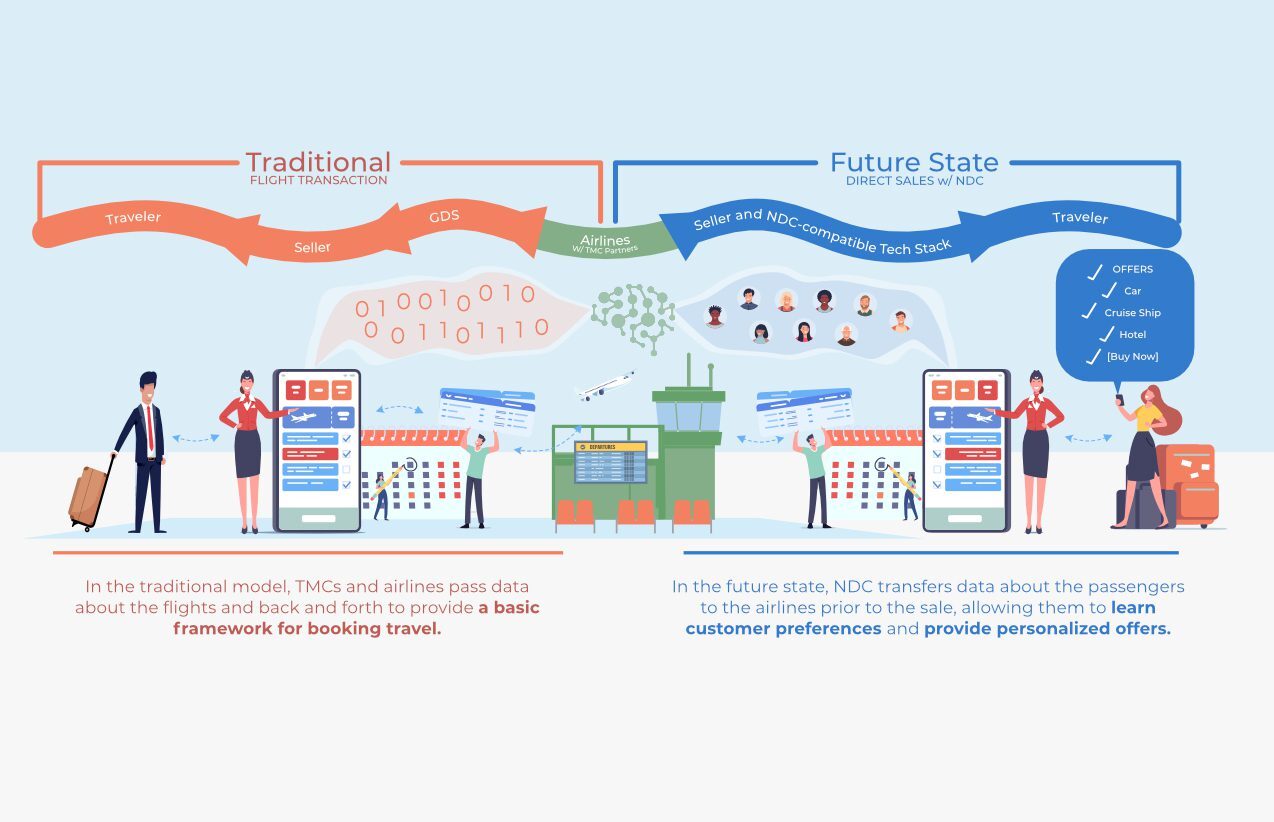

In this article, we’ve done our best to pick the most relevant details about how air travel is booked now, what’s changing with the introduction of new distribution capabilities (NDC), and what it means for the future of travel management.

How Air Travel Gets Booked

Airlines – There are over 5,000 airlines worldwide with a wide range of fleet sizes and seats available. American Airlines is the largest by fleet size and passengers (over 500,000 per day)!

Inventory – Each of these airlines has seats available each day. That’s their inventory.

GDS – Airlines report that inventory to distributors, called global distribution systems (GDS).

- The biggest GDSs are Amadeus, Sabre, and Travelport.

- A GDS can connect and distribute data between sellers (travel agencies), cruise lines, airlines, car rentals, and hotels.

CRS – Each GDS provides a Computer Reservation System (CRS) that sellers can use to find inventory and book travel. CRSs power most business travel transactions.

- The GDSs have developed rich graphic interfaces and can provide a one-stop shop for sellers.

- Over the 30+ years GDSs have existed, vendors have developed GDS-compatible integrations and automation that help sellers operate more efficiently.

Sellers – Corporate travel agencies, travel management companies (TMCs) and their agents, online booking tools (OBTs), self-service software, and online travel agencies (OTAs such as Expedia) are examples of sellers of travel. They use the CRS provided by their choice(s) of GDS to find inventory that matches the needs of travelers.

PNR – When a seller finds a seat for the passenger, they book it and create a Passenger Name Record (PNR). The concept of PNR was first introduced by airlines as a way of exchanging data when a single passenger’s itinerary requires flights with multiple airlines.

- The PNR provides a handful of required data points like passenger name and itinerary details, and it can also include dozens of optional pieces of metadata (e.g., tax amounts, passenger age, and special requests).

- Any one itinerary may include multiple pieces of inventory getting booked and linked by ID to a single PNR. And once a piece of inventory is booked…

Synchronization – …that booked inventory is no longer available. The GDS sends updated data to the airline. Remember—there’s more than one GDS, so the updated inventory information needs to be retrieved by each of the GDSs so that the same seat isn’t sold twice.

Ancillaries – Ancillaries are additional offerings like extra bags, wifi, lounge access, and meals that can be upsells to a basic booking. It’s hard to imagine this in 2023, but each of those upgrades is a separate transaction for the seller. There’s no online shopping cart and no one-click purchase.

The Money Trail – Travelers (or their corporate employers) pay airlines. GDSs charge airlines a fee for each booking. And the GDSs typically pay an incentive to sellers based on their volumes.

__________________________________

That’s been the standard distribution model for air travel for over 30 years. So why is it changing?

The existing model has some constraints:

- GDSs can’t bundle or unbundle content (flight inventory and ancillaries) to create a seamless buying experience.

- Airlines don’t have much control over how their inventory is packaged and sold.

- Airlines don’t have information about travelers at the point of sale, so there’s no opportunity to present personalized offers.

And we live in a digital age now:

- Consumers expect online shopping carts and one-click purchasing.

- Businesses (airlines) expect to be able to learn from consumer behaviors, provide personalized offers, and bundle products to upsell in each transaction.

So, the IATA got involved.

__________________________________

IATA – the worldwide trade organization for airlines. They provide global standards for airline safety, security, efficiency, and sustainability. in 2015, IATA introduced a standard (NDC) designed to provide new opportunities for airlines and travelers.

NDC – New Distribution Capability is a standard for data transmission that allows airlines to interact more directly with customers and sellers, provide personalized and bundled offers, and distribute their ancillary offerings in real time.

For airlines, this means a deeper understanding of their customers, which should translate to more profit. Since direct booking transactions are less dependent on GDSs, airlines will pay lower fees and retain more of each ticket sale.

NDC is a clear financial win for airlines, but a potential hit to GDSs and sellers. With GDSs making less money per transaction, there’s not enough for them to pay as much in incentives to sellers. So, sellers will be challenged to find new revenue channels. And at the same time, they will need to invest in their technology stacks to better support the diversity of inputs and outputs that are the current-state reality.

Where We Are Now + What’s Next

As of mid-2022, about 10% of third-party airline ticket sales were booked with NDC-enabled technology. A new IATA working group has been formed with the goal of speeding up the adoption of “modern airline retailing” by 2030. That’s quite a way out. What do we do in the meantime? How does an industry determined to modernize deal with 90% of its transactions remaining in legacy technology?

Leisure travelers are increasingly buying directly from airlines as they are able to produce more competitive, bundled, and personalized offers.

TMCs will need to take control of their tech stacks or be at significant risk of losing business. In order to offer corporate travelers the best fares and options, TMC agents and online booking tools need to be able to hop between GDS systems and NDC-enabled systems and use each for what they do best.

In the past, sellers were able to rely on the CRS interfaces developed by the GDSs as a one-stop shop. And many are hoping the GDSs will also adapt fully to NDC. But in order to run efficient agencies and create more seamless experiences for their agents and end customers, sellers are going to need to invest in technology stacks that integrate data from multiple channels and automate workflows. The future desktop of the mid-office TMC is up in the air. Not every agency will conquer the technology transition. For the agencies that survive, the competitive landscape will look much different. And they will be able to provide better deals and offerings than ever.