It’s that time of year where budget planning is in place and critical reviews of current year spending are being analyzed. When it comes to looking at lowering costs while improving productivity, corporate travel policies rank high on the list. However, no longer can corporations afford the luxury of developing one program suited to all travelers and stay rigid throughout the year on compliance. With the introduction of new technology at an accelerated pace, a “one size fits all “approach no longer works

What is the catalyst for this transformation? In the forefront is the ability to leverage data to provide detailed insights into understanding traveler segments, differences in demographics – Millennials patterns compared to road warriors, statistics on spending outside of policy compliance and more.

For the second year, CWT and the Global Business Travel Association (GBTA) have produced the 2016 Global Travel Price Outlook, which provides a foundation for discussion as budget analysis and planning begins.

Airlines

Source: GBTA and CWT

Costs are expected to increase across all travel segments in 2016. Starting with airfares, 44% of travel managers feel higher airline costs will be responsible for increases in travel budget with the continued rise of ancillary fees being one of the top contributors. The ability to consolidate data related to ancillary fees provides a platform for negotiations with air carriers for the upcoming year.

In some cases, due to the lower prices of oil, airline fees have remained relatively flat, and now there is a fear that the consolidation of players will impact pricing. According to the study, 54% of travel managers in Europe anticipate negotiated discounts with airlines to remain the same in 2016, while 22% think discount prospects will be worse.

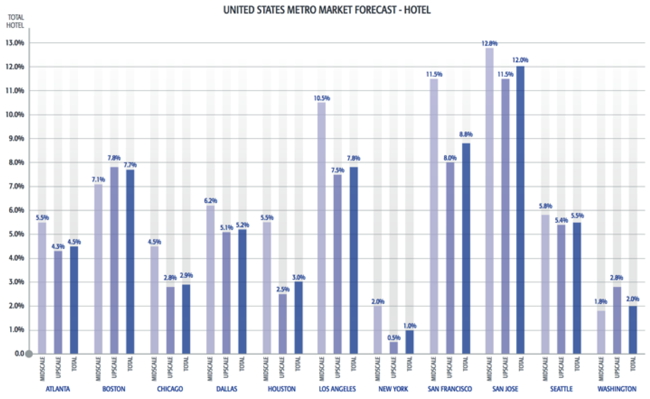

Hotels

Source: GBTA and CWT

Another segment expected to see price increases is the hotel industry. Areas to watch out for are a continued push in purchasing ancillary services, especially with the ability to market these offerings in a personal way pre-arrival with mobile check-in. Additionally the push toward a dynamic pricing model, as opposed to flat rate negotiations, continues to rise from the accommodation side. Pursing discounts off best available rate as opposed to offering one flat rate yearly compliments the revenue management strategies of increasing average daily rates at hotels.

When examining policies regarding hotels be sure to also take into account more stringent cancellation policies and the growing number of shared services such as Airbnb and the direct to consumer marketing to travelers by online travel agents.

With demand levels once again increasing in the US, a 4.7% increase in rate is projected in the United States surpassing the majority of the Americas except Venezuela claiming a record 15.2% increase

Ground Transportation

Usually under the radar and not in the forefront of spending accountability, ground transportation is often neglected where this might be the best opportunity for cost savings. Accounting for up to 4-6% of a company’s travel spend, the growing emergence of new players such as UBER can have a significant impact not only on spend but on compliance as well.

As corporations move through the planning process, the most important element is making sure you can see the complete picture by having all the data at your fingertips. We need data to define our travel trends, data to measure trip effectiveness, data to understand our behaviors and activities and data to understand our financial patterns and limitations. Airlines, Hotels, and Car Rentals are beginning to generate this kind of data and repurposing it in a format that is understandable and actionable for the traveler.

Secondly, schedule regular intervals to evaluate the overall effectiveness of your travel policy. Market conditions, new technology, and diverse demographics help guide continual tweaks to standard operating procedures throughout the calendar year.

Finally do not be afraid to re-approach suppliers during the year to negotiate new terms. A company’s dynamics change due to so many circumstances, (signing a major client or losing a major client), that developing a good relationship with your TMC or supplier contact could potentially be the key to tremendous savings.