Webinar Questions and Answers

Thanks again to our panelists for sharing their insights on the role of data for business travel during the early stages of the COVID crisis and in its recovery.

A recording of the entire session can be found here:

There were many questions that we did not have a chance to address during the session. The responses below represent the collective view of the four of us.

Enjoy, let’s keep the conversation going and stay safe, everyone.

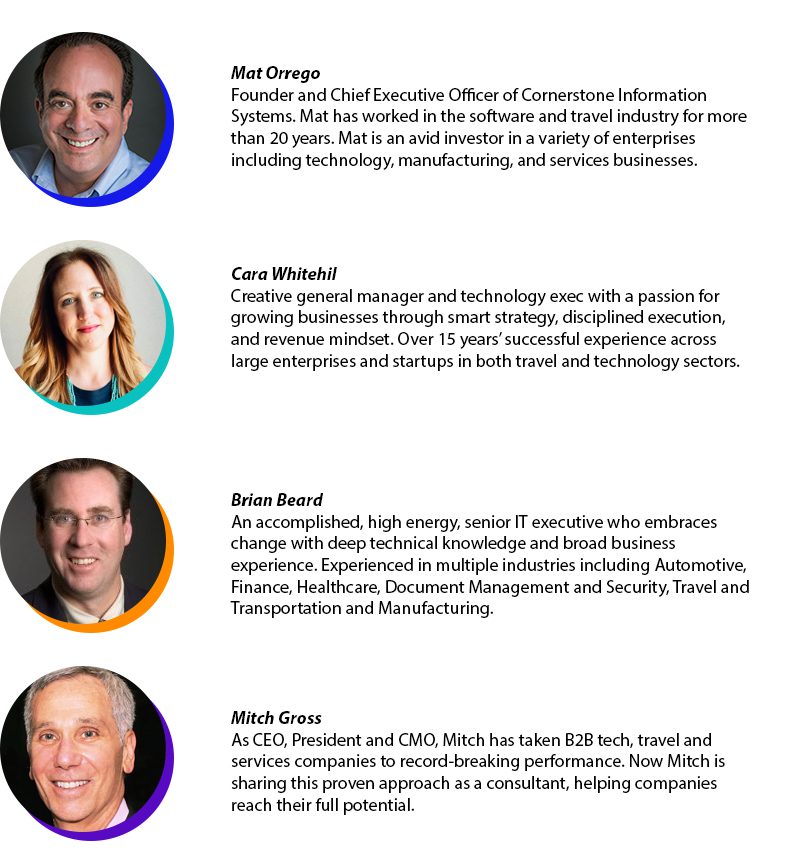

- Mitch Gross, 12 Squared Growth

- mitch@12squaredgrowth.com

- Mat Orrego, Cornerstone Information Systems

- mat@ciswired.com

- Cara Whitehill, Traxo

- cara.whitehill@traxo.com

- Brian Beard, Data Visualization Intelligence Inc.

- bbeard@dvibigdata.com

Do you think corp travelers will now comply more with their corp travel programs instead of managing their own bookings just to have peace of mind in terms of safety, cleanliness etc? Thus making it easy to deliver Duty of Care post COVID-19?

Everyone wants to stay safe and travelers may have seen how important it is to be communicated with in a crisis. So it’s natural that they would be more compliant. The big IF: compliant with what? Companies and TMCs will have to double down on communication so that people know what they are supposed to do and why.

Policies are also likely to address a different set of issues, like which destinations, what types of properties and what ground transportation are recommended. Driving travelers to approved channels is critical so they can be guided to the safest solutions. And most travelers should like that.

For strongly mandated programs, it’s likely that compliance to mandated channels will increase a bit in the near-term, but the reality is that there will always be some blindspots no matter how strong a mandate companies have (execs who prefer to do their own thing; meetings and events which require booking via separate channel; better rates found outside the TMC; day-of-travel disruptions that are impossible to handle in-channel; etc). That’s been the case for every major disruption we’ve seen — behavior always reverts to the mean, and that “mean” means some amount of program leakage.

A more realistic and practical approach is to leverage data aggregation solutions to catch this off-channel data and feed it into Duty of Care services and other management workflows pre-trip. Many travel teams may not realize this is possible, but tech has evolved so that you can manage this activity just as you do your in-channel activity. That way, you fill in the gaps in these off-channel blind spots and ensure you can keep employees safe and accounted for.

Bottom line, we think corporations will push for improved compliance within their programs. Although, many travelers will continue their behaviors unless the employers develop stricter ramifications for non-compliance. Duty of Care data will go up a level in importance and new ways to acquire out of program bookings will be developed.

I just got on the call so you may have discussed this already, but do you think leakage will decline significantly post covid-19? Companies will run tighter programs requiring additional pre-trip approvals?

Again, leakage is likely to decline if expectations and the rationale behind them are clear. At minimum, we can expect more pre-trip notification on out of policy bookings. In many cases pre-trip approval will also increase, especially in the early days of the recovery.

We may see a short-term increase in compliance, but it’s unlikely that leakage will decline much in the long run. The underlying drivers of leakage aren’t going away just because of the pandemic, and given that there are tools available to travel teams to manage this activity the same way they manage in-program activity, it’s going to become less of a problem.

The same is true for pre-trip approvals. As travel returns to normal. Companies that had a pre-trip approval process will continue to use it, other companies will opt for increased communication about updated travel policies instead of implementing a pre-trip approval process.

What are your thoughts on blocking nonrefundable hotels?

It makes sense as an interim measure for hotels and for air too. Even though most properties are waiving refund restrictions and cancellation fees, this can change at any time on a supplier by supplier basis. Blocking puts control back in the company’s hands and avoids potential hassles in tracking refunds or credits. But you’ll need to work with your TMC to be sure this is technically feasible.

You won’t be able to control this with off-channel bookings, including use of consumer and supplier. Communication and education, as always, is as important as the policy and tech change. And a solution to identify and act on off channel bookings should be a fundamental part of any travel program.

How does Traxo separate business vs personal travel within the supplier feeds?

Suppliers prompt the user to specify whether their trip is for Business or Personal travel; if Business is selected, then the supplier will show the traveler their company’s private negotiated rates for that business trip, and feed the data to Traxo so it can be synced to their company’s duty of care provider as well. If the user specifies a Personal trip, then they continue on the normal booking flow and no data is sent to Traxo or their company. This ensures that only business travel bookings are captured and fed into the company’s travel management workflows (ie, duty of care).

Do you see companies enforcing more stringent travel policies to diminish or get rid of leakage in the name of Duty of Care?

Yep.

In the near term, this may be likely for programs that already have strong mandates. Given the tools available now to capture bookings from any source, including “leakage”, and sync them with a Duty of Care provider, this will be less of an issue in the long run.

How have companies managed Duty of Care for meeting attendees?

We saw a few companies that had meetings challenged by this and especially the meeting organizers that had to take safety into consideration. Most of our clients that managed internal meetings cover their employees’ participation as part of their regular duty of care policies. In the “New Normal” we will see a lot more consideration for safety of and verification of perhaps healthiness when bringing people together in groups.

Solutions that capture off-channel bookings, like Traxo, can capture meeting and event booking details (ie, via PassKey, hotel-direct, etc.) and feed these to a company’s Duty of Care provider. So they get the same Duty of Care coverage as TMC bookings.

It’s great to capture off-channel booking however the caveat to that is the lost discounts and support.

Yes, as well losing the data for supplier negotiation and the extra work to find people, process refunds, and increase policy compliance.

Capturing off-channel bookings is just the first step. There is no point in capturing the transactions if you don’t do anything about it. This could include education, either at the point of sale if your tool permits, or via management follow up afterward. Transactions can also be canceled and rebooked if captured in time,

Capturing the details for off-channel bookings *before* the trip is the key here. That enables the travel team to proactively respond if a rate is higher than the company’s private negotiated rates or policy limits, and also enables these bookings to be fed to price monitoring services like TripBAM or Yapta. Relying on expense reports or credit card reports after the fact won’t help you here, because it’s too late to change the booking.

Additionally, most suppliers can now enable a company’s private negotiated rates to be bookable directly on their website or mobile app, so your employees can actually get your same discounted rates booking directly with airline or hotel sites. Using a data aggregation service to sync those booking details to your Duty of Care, TMC, and reporting tools means you get the discounts, support, and Duty of Care coverage for these bookings just as you do for your in-program bookings.

I have many travelers that are going directly to the airline or hotel to cancel their reservations vs. our TMC, which is not common for us (we have mandated policy and very good compliance). I think they maybe just panic cancelled. This is creating a mess in our normally very accurate reporting; any suggestions on how to recover from this reporting mess?

This one is going to be a little painful as you may need to come at from multiple angles. You might start with pulling reports from your TMC, expense and card systems on bookings for travel in March onward, including any future bookings. Once you have identified trips and travelers, you can filter out the ones that were processed via the TMC.

Once you have the list of transactions by supplier, you can reach out to get status on refunds. If you haven’t been notified, it is fair to assume no refunds. Follow up with travelers directly on transactions the suppliers say were already made.

Most important will be to have a good system to track unused ticket or hotel credits so you can be sure you get the full value for any transactions that won’t be refunded in cash.

For us we often saw traveler bookings with us coming through to the GDS but then cancelling at the hotel directly to jump on a plane to get home, so for our data the traveler would still show in that location. Even if we received notice, our agents couldn’t manipulate the booking since it was now past date. Any suggestions or ways to address this to make the data more accurate? In our case, we figured it’s better to cast a wider net and still capturing / reaching out to them. Just interested if anyone else experienced this.

While the best practice is to edit the reservation, we saw a lot of database changes in downline reporting processes. This made it difficult to maintain a single version of the truth. The reality is the industry is challenged with synchronizing changes management issues and it’s something that needs to be addressed.

Do you feel like this is a good opportunity (call it silver lining) that our Travel Managers and Travel Agencies are talking to travelers? Reminding us of the personal touch that “IN THIS TOGETHER” moment.

100%. The research and our personal experience shows that most travelers really want to do the right thing for their companies but they often don’t know what they are supposed to do. So use the opportunity to not only rally people together but also to let them know what they should do.

The old advertising principle that people need to hear something seven times before they remember it applies here. So you’ll want frequent but varied messages. And people are more distracted than ever, so keep it short.

Finally, you can lead by example, proving that we’re in it together by showing the things you are doing to improve their experience and keep them safe and healthy.

This is also a great proof-point for travel teams and their service providers to uncover critical gaps in their existing programs, and create an incentive within executive teams to allocate budget to address these gaps. Corporate travel teams may not always get the C-Suite exposure they deserve, and often are regarded as purely a line-item on the cost side. This situation is highlighting how critical business travel is to a company’s operations, so it’s a perfect opportunity for travel teams to push for exec level support and resources to upgrade their programs for effectiveness and efficiency.

How do you think about future liability around business travel and how it will affect demand with anticipated recurrence of coronavirus in the fall and winter of this year?

None of us are legal experts so we won’t address the legal liability issues. On the business travel side, there will probably be an “abundance of caution” regarding destinations, property selection, carriers and dining. Cash will also remain very tight well into the recovery and airline capacity is likely to be limited, especially if blocking middle seats continues. All these point toward a slower rebound.

But we have to balance this with an eagerness to stimulate sales and reconnect with clients and business partners. So it’s impossible to predict. Overall, the market is likely to remain skittish with shorter advance purchase windows and fewer restricted fares and prepaid rooms to allow people to react to the latest conditions on a location-specific basis.

A recurrence is likely to trigger a heavy pull-back in travel spend. We expect companies to be very cautious around traveler safety.

The risk of a recurrence also underscores the need for travel teams to get their programs tuned up ASAP. They need to address the data gaps and operational workflows that didn’t perform well the first time around.

One of the challenges experienced among buyers is being able to communicate directly and in a timely proactive and ongoing fashion with impacted travelers and their managers, to provide direction in crises. Are reporting companies incorporating key contact information and a portal for travel managers to communicate with impacted travelers in an effective way or is the reliance on this info only through the TMC?

We are seeing increased demand for data products, especially those that tap multiple sources or help capture off-channel bookings. That was a major pain point. Most products, TMCs and duty of care providers already offer locators, reporting and communication. The key thing is to be sure they are set up properly, kept up to date and tested periodically, just like you should do with your smoke detectors at home.

Do you think corporations are going to get much more engaged with their TMC’s in solving the “one keeper of the truth” solution for their data or even possibly taking it into their own hands and not wait on their TMC’s to figure this out as they have been?

We think many corporations will dive into their data issues, especially for traveler tracking, refund management and unused ticket consumption.

They would like to see their TMCs get more proactive with technology solutions to help in this area, but the reality is that TMCs likely do not and will not anytime soon have the resources to do this. TMCs are terrific partners for service, support, program strategy, and supplier negotiations, but most are not technologists. Traxo is seeing more TMCs looking to partner on this front, where we can be a data source/technology partner for them so they can do what they’re best at, but do it with a more comprehensive data set.

Travelers sometimes book / search off the TMC channel because it’s the only option given for loyalty benefits. Do you see travel programs starting to include additional options (such as airline approved sites) and how would you collect and manage that data?

We’re likely to see a few approaches. One is supplier direct deals where corporate deals are honored and data is piped in. But this still creates issues for traveler tracking, disruption management and refund handling. Some TMCs already help on these issues, generally for a fee, but it’s not a simple task.

Many airline and hotel sites already support company’s negotiated rates on the airline or hotel website/mobile app, in addition to loyalty benefits. Suppliers who do this can also feed the booking details back to the company’s Duty of Care provider and other reporting tools so that these bookings get the same coverage as TMC bookings. Quite a few companies already allow this (take a look at Suzanne Boyan at ZS Associates, BTN Travel Manager of the Year, who is doing this with her program).

With suppliers including TMCs staffed so differently as a result of this, do we think that suppliers will be structured so differently that it will be challenging for buyers to decide how they will work with them given that the service model may be very different?

We’re probably going to see a variety of approaches as suppliers including TMCs try to figure out the best approach to servicing while keeping a tight rein on managing expense and staffing. That’s really healthy – the industry has always been creative in addressing issues like this. But it is probably going to be chaotic for a while as there won’t be a single solution.

And it’s not just on the servicing side. You can expect technology to play a role in order to improve speed, servicing and cost. Pricing models are also evolving, with some already offering SaaS models.

So yes, a wave of innovation will increase complexity and it will take a little time to work out the kinks and for new models to gain adoption and become the new normal. Harder in the near term, really healthy and exciting in the long run.

What was Traxo’s most surprising learning from your data insights during COVID19?

Air “leakage” was one point that we’ve noticed is much higher than people typically think.

Giving travel teams detailed visibility into off-channel bookings, particularly the upcoming travel, was huge – it enabled travel teams to be far more proactive in cancelling trips than they otherwise would have been. Also, the historical visibility turned out to be a major benefit, because clients could very quickly identify employees who had recently been to China, Italy or other COVID hotspots instead of waiting for those employees to file an expense report at some distant date. This could have direct impact on employees’ & coworkers’ health.

I’m guessing Traxo can REALLY help with the unused ticket MOUNTAIN that all will deal with – can you elaborate?

Yep! Since Traxo captures the flight receipt details at the time of purchase, clients have the record of the transaction including the key details they need to submit for refunds (ie, ticket number, flight number, travel dates, etc.). Travel teams can download a report with that detail for their flight bookings, and either action it themselves or share it with the TMC to centralize efforts.

Thanks again for joining us!